The latest research shows that around 73% of customers find live chat the most satisfactory form of communication with a company, with 63% of customers more likely to return to a website that offers live chat. And for those in the finance sector, where a tough economy is making sourcing and retaining clients that much tougher, chat is a great way to make the business more accessible and appealing. Here’s a look at how chat provides customers with the relevant financial solutions.

What is live chat?

This is a type of customer messaging software that lets your customers connect directly with company representatives. For your business, it can work as a pop-up chat window on the company’s website, providing customers with a quick and easy way to get the information they need. With live chat you can decide whether it will be:

Reactive: Waiting for the customer to start the chat

Proactive: Initiating the chat so the customer can engage

What are the use cases of chat for finance?

“Offering live chat is a great way to offer competitive customer support, but at the end of the day, it is only worth doing if you do it well. This is an extension of your company that has the potential to enrich customer satisfaction, drive brand loyalty, increase sales and save time.” - Forbes

1. Chat to provide financial advice

The chat software is able to deal with customer requests, while also gathering useful customer-related information. This means that all customer accounts and spending habits can be quickly noted, allowing chat to provide financial advice tailored to the individual. This can include tips on budgeting, the best way to start a savings plan and other financially relevant information.

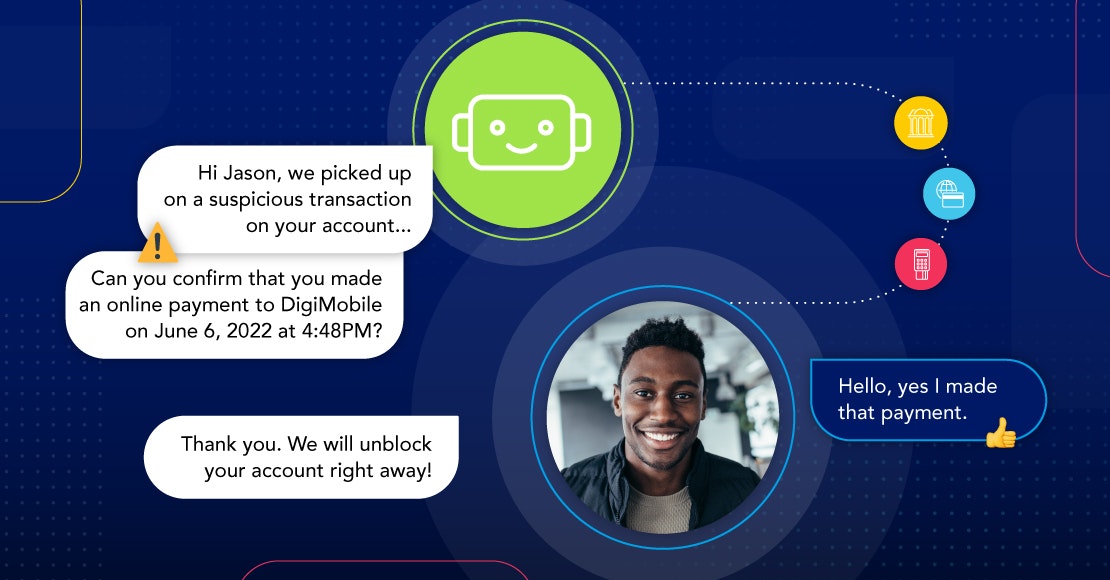

2. Chat to prevent fraud

When dealing with customers online, the risks related to data theft are increasingly high. According to Fortinet, the use of malware increased by 358% through 2020, with ransomware use increasing by 435% when compared with the previous year. In July 2020 alone, there was a spike in malicious activity of 653%. These numbers are substantial and make dealing with customers’ data that much more important. Fortunately, chat can monitor and recognize warning signs of potential fraud, sending alerts directly to the financial institution.

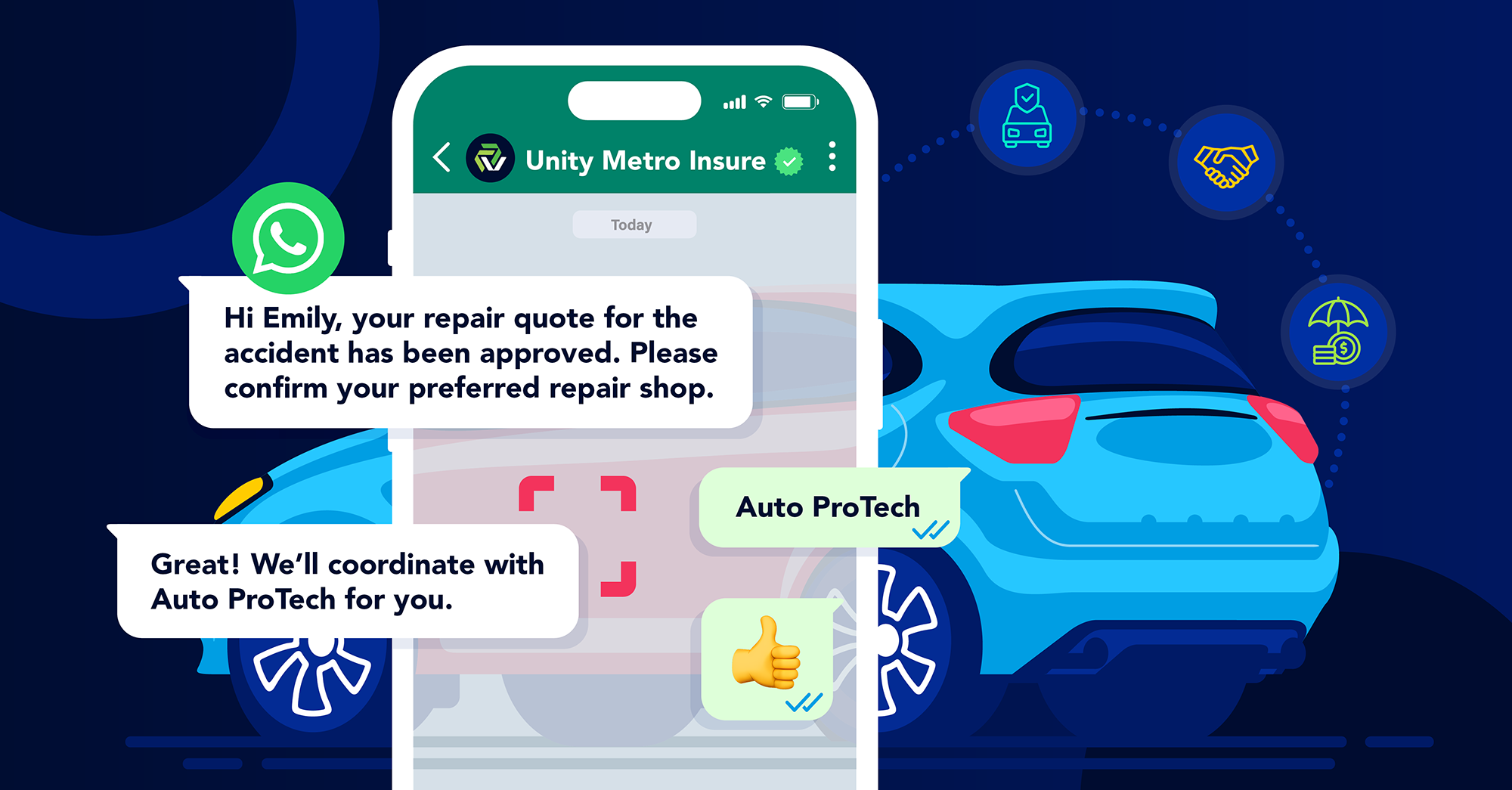

3. Chat for customer support

As we touched on in the introduction, chat is key to providing valuable customer support and will only continue to grow in popularity if implemented correctly. Using WhatsApp chat, your business is able to provide financial support to customers 24/7 which means quick response even when your customer representatives are busy.

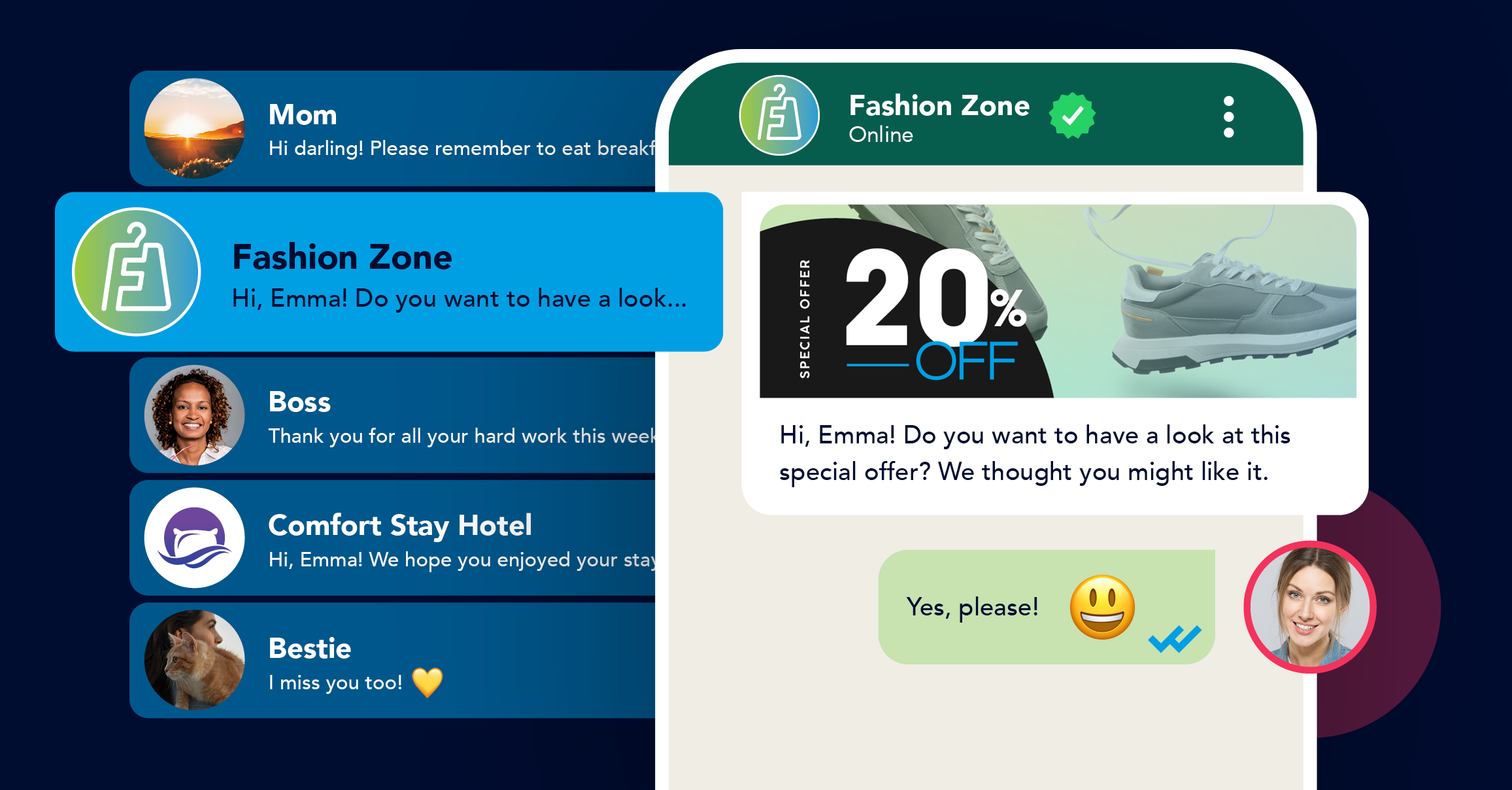

4. Chat to launch new services

Financial institutions are constantly having to keep up with changing customer needs using the latest technological innovations available. But it’s no use having new products and services if customers don’t know they’re even available or how to access them. That’s where the chat feature is so important. By communicating with customers through chat, financial institutions can alert customers in real time to their latest offerings, as well as provide step-by-step assistance along the way.

What are the benefits of chat for finance solutions?

We’ve shared some of the practical uses for chat in a financial setting, but there are so many more benefits associated with this type of software. Here’s a look at some of the more dominant ones.

- Real-time responses for customers

There is nothing worse for a customer than having to put up with annoying call-waiting music or being turfed from one representative to the next without ever receiving the necessary assistance. So, despite the ease and convenience that phone calls provide, they can often become time-consuming and frustrating. That’s where chat is so beneficial. According to HubSpot, nearly two-thirds of customers report they expect an immediate response from a support team - within 10 minutes. With live chat, there is always a real-time response for a customer looking for an answer to a query. And with live chat, there’s access to the client history which means agents aren’t having to nag the customer repeatedly for the same information.

- Proactive engagements

With chat being both reactive and proactive, you’re meeting your customers’ needs while also generating leads. The proactive response means that you’re able to use the information you’ve gained about your customers to reach out to them directly. If a customer is struggling with making a decision, this will prompt an agent to reach out and offer assistance with any issue.

- Language-friendly chat

For financial institutions that are operating globally, they can benefit from a chat that can communicate in a number of languages. The chat software can translate each conversation, which allows customers and agents to engage directly in their own languages. This way, chat is breaking barriers and opening opportunities across the global space.

- Cost saving

There are financial benefits of using chat software that make it so worthwhile. Because the live chat option is able to provide systematic responses, it frees up agents’ time to focus on other business-driving tasks and duties. Agents are also able to multitask, dealing with several queries at once. This translates into massive cost savings for businesses. In fact, a report indicated that organizations using chatbots in 2019 saved an average of $300 000.

- Customer feedback

The value of customer feedback cannot be overstated. You’re finding out exactly what is needed from your company, directly from the people who need it. Chat is able to assist you on this journey. It provides you with comprehensive analytics on the customer experience, as well as allowing for pre-chat and post-chat surveys. Once you have this information, you’ll be able to make informed decisions to improve your service offerings and remain competitive.

How to get started with chat solutions

It’s quite clear that any business remaining true to the customer-centric model will be looking to improve operations through chat. When it comes to getting started, your best option is to contact Clickatell. Through our WhatsApp chat, we enable your customers to securely transact, receive 24/7 support and time-critical notifications via the world’s most popular chat channel.

Step into the future of business messaging.

SMS and two-way channels, automation, call center integration, payments - do it all with Clickatell's Chat Commerce platform.